The above example is the simplest form of income statement that any standard business can generate. It is called the single-step income statement as it is based on a simple calculation that sums up revenue and gains and subtracts expenses and losses. Notice the balance in Income Summary matches the net income calculated on the Income Statement. If we had not used the Income Summary account, we would not have this figure to check, ensuring that we are on the right path.

- Check out this article talking about the seminars on the accounting cycle and this public pre-closing trial balance presented by the Philippines Department of Health.

- The business is said to make profits if the credit portion of the income summary statement is more than the debit side of the income summary statement.

- Ultimately, horizontal analysis is used to identify trends over time—comparisons from Q1 to Q2, for example—instead of revealing how individual line items relate to others.

- If dividends are declared, to get a zero balance in the Dividends account, the entry will show a credit to Dividends and a debit to Retained Earnings.

- Reducing total operating expenses from total revenue leads to operating income (or loss) of $69.92 billion ($168.09 billion – $98.18 billion).

Please refer to the Payment & Financial Aid page for further information. Updates to your application and enrollment status will be shown on your account page. We confirm enrollment eligibility within one week of your application. HBS Online does income summary not use race, gender, ethnicity, or any protected class as criterion for admissions for any HBS Online program. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English.

RESTRICTED CASH: Definition & Its Financial Statement

This is remarkable considering it was a growth-focused airline and still had net cash after a pandemic. The stock sells at an attractive low-doubledigit P/E, but we do not need multiple expansion for this investment to contribute well to our portfolio income and capital appreciation objectives. We believe simply continued execution of the business should lead to solid returns. From this trial balance, as we learned in the prior section, you make your financial statements. After the financial statements are finalized and you are 100 percent sure that all the adjustments are posted and everything is in balance, you create and post the closing entries. The closing entries are the last journal entries that get posted to the ledger.

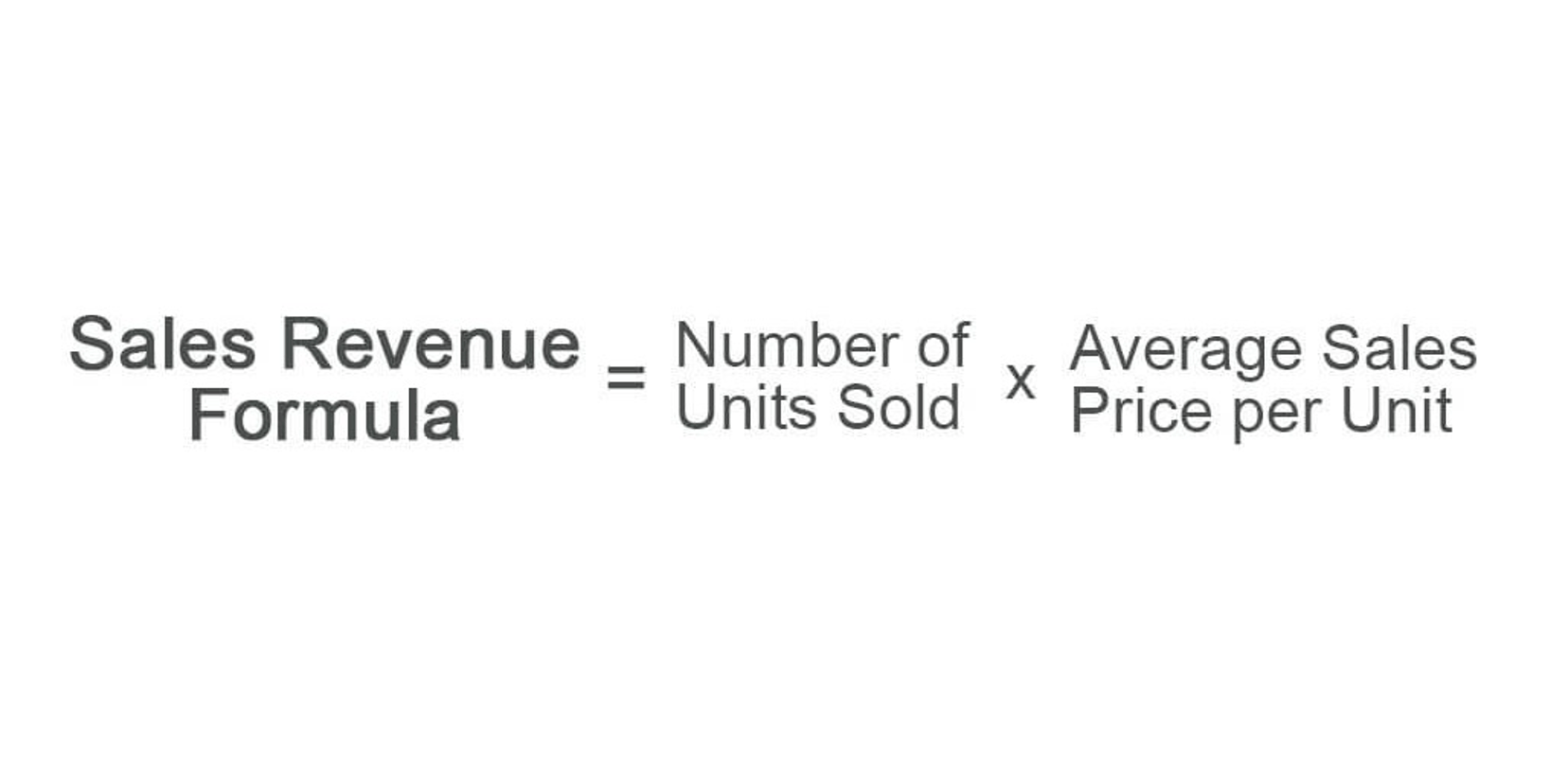

We appreciate that until there is greater clarity on the total settlement cost, the stock may remain under pressure, but at the current asking price, shares sell at a significant discount to our estimates of intrinsic value. Let’s move on to learn about how to record closing those temporary accounts. These “buckets” may be further divided into individual line items, depending on a company’s policy and the granularity of its income statement. For example, revenue is often split out by product line or company division, while expenses may be broken down into procurement costs, wages, rent, and interest paid on debt. An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. You record the income summary amount by adding the total expenses and total income and then transferring them to the balance sheet.

Free Accounting Courses

An income summary is a crucial financial statement used in accounting to compile and summarize the revenue and expense accounts of a business during a specific accounting period, typically at the end of a fiscal year or reporting period. Its primary purpose is to facilitate the closing of these temporary accounts and prepare the books for the next accounting cycle. Remember the income statement is like a moving picture of a business, reporting revenues and expenses for a period of time (usually a year). We want income statements to start every year from zero, but for accounts like equipment, debt, and cash accounts—reported on the balance sheet—we want to keep a running balance from the beginning of the business.

The accounts that need to start with a clean or $0 balance going into the next accounting period are revenue, income, and any dividends from January 2019. To determine the income (profit or loss) from the month of January, the store needs to close the income statement information from January 2019. Zeroing January 2019 would then enable the store to calculate the income (profit or loss) for the next month (February 2019), instead of merging it into January’s income and thus providing invalid information solely for the month of February.

How to Read & Understand an Income Statement

While the company’s growth can ebb and flow, over the long term, the company has experienced average annualized organic growth in the high single digits, supplemented by small tuckin acquisitions. With a record of consistently generating free cash flow and prudent capital allocation that includes high return of capital to shareholders, this stock fits our process. A net loss would decrease owner’s capital, so we would do the opposite in this journal entry by debiting the capital account and crediting Income Summary.

At the end of a period, the balances of all income and expense accounts are transferred to the income summary account. Afterward, its balance is transferred to the retained earnings (for corporations) or capital accounts (for partnerships). This moves income or loss from an income statement account to a balance sheet account.

Operating Expenses

To get a zero balance in a revenue account, the entry will show a debit to revenues and a credit to Income Summary. Printing Plus has $140 of interest revenue and $10,100 of service revenue, each with a credit balance on the adjusted trial balance. The closing entry will debit both interest revenue and service revenue, and credit Income Summary.

It is also possible that no income summary account will appear in the chart of accounts. The first step in preparing it is to close all the revenue accounts. There are three steps to preparing this form, all relatively simple.